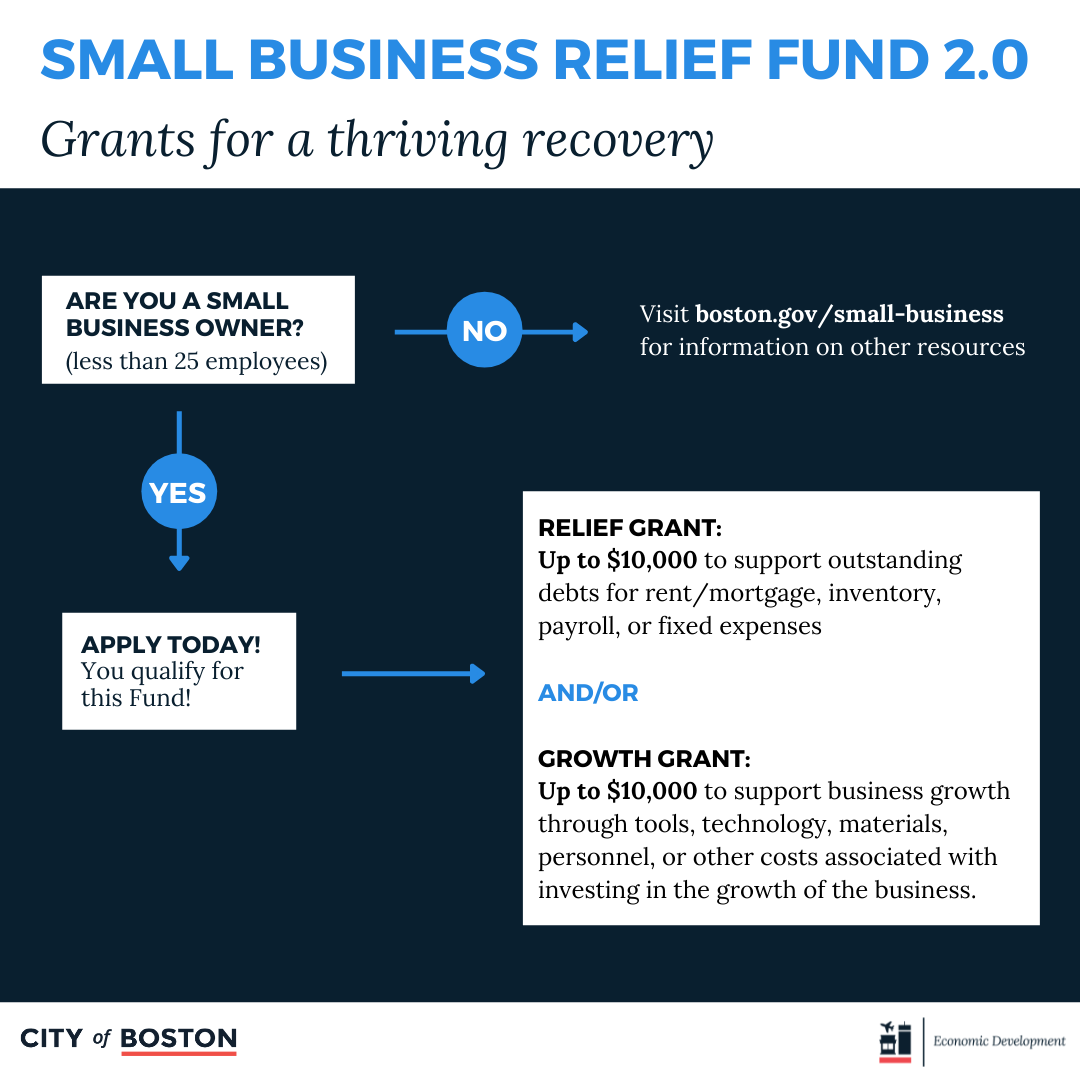

Small Business Relief Fund 2.0

Please note: The fund is now CLOSED and we will not be accepting any new applications.

The City of Boston will be replenishing the Small Business Relief Fund 2.0 with $5 million. These funds will help support additional Boston small businesses as they continue their recovery.

The replenishment of the fund will reopen applications for the Small Business Relief Fund, which was initially launched in April 2020, and relaunched in September 2021. The fund will close to new applications on Friday, April 15, 2022, at 5 p.m.

Types of grants

Businesses will be able to apply for two types of grants:

Relief Grant:Up to $10,000 to support outstanding debts for:

- rent or mortgage

- inventory

- payroll, or

- fixed expenses.

Up to $10,000 to support business growth through:

- tools and technology

- materials and personnel, or

- other costs associated with investing in the growth of the business.

Businesses can apply for one or both grants. These funds may only be used for expenses incurred between March 3, 2021 - December 31, 2024.

We will prioritize funding businesses in industries most directly affected by closures, policies, or general loss of revenue related to COVID-19. We also want to help businesses looking to expand in 2021 and beyond. These include but are not limited to:

- food service and production, restaurants

- bed and breakfasts, small hotels, short term rentals

- house cleaners

- laundromat or dry-cleaners

- car repair and garages

- funeral homes

- barber shops and beauty salons

- arts, entertainment, and the creative economy

- tourism

- fitness, wellness, and recreation

- transportation and warehousing

- home and healthcare workers

- childcare, and

- retail.

All applicants will be considered for one or two grants. We will allocated grants primarily according to the budget included in the application. Businesses will be able to apply for a Relief grant or a Growth grant, or both.

Relief grants must be used to help businesses address:

- fixed debts and payroll

- accounts payable

- lost sales and opportunities, and

- other working capital expenses that could have been recognized had COVID-19 not occurred.

Growth grants must be used on:

- tools

- materials, or

- personnel to invest in the growth of the business.

Businesses will need to provide proper documentation of proof of use of these funds within 90 days of the issuance of the grant.

How to apply

All applicants must meet the following criteria to be considered for a grant. We will not process incomplete applications.

- You must have a valid Vendor ID from the City of Boston.

- Your business needs to have fewer than 25 employees.

- You must have proof of a Boston business address (for example, a signed lease, business permit, license, or title, a utility bill in which the business is named directly, or other home office documentation).

- The business must be in good-standing with the City of Boston, along with the business owner.

- You must provide a copy of an up-to-date Business Certificate or current Certificate of Organization from the Massachusetts Secretary of State's Office, if your business is a corporation. If your business uses its corporation name in all facets of its business, then that business does not require a business certificate.

- You must provide proof of payroll (for example, a recent pay or wage statement, bank statement, or proof of paystubs) if there are more than two employees.