Protecting your credit rights

We work with the Massachusetts attorney general to educate consumers on a variety of topics. Learn about your credit rights and fair debt collection practices.

GET YOUR CREDIT REPORT

You have the right to one free credit report every year. Your credit report shows your history, like the amounts owed on your credit accounts, length of credit history, and payment history. It does not show your credit score. Credit reports may affect your credit card approvals and mortgage rates. It is important to review your credit report to help you catch signs of identity theft.

If you applied for credit and got denied, you should get a copy of your credit report to make sure all the information is correct and up to date. You have the right to know who reported to the creditor within 60 days of the denial.

Generally, negative information — like a collection account — stays on your report for seven years. Some information, like bankruptcies, will stay on your report up to 10 years.

You can contact the three major credit bureaus to get your reports:

- Experian: 1-888-397-3742

- TransUnion: 1-800-888-4213. Call 1-800-680-7289 to report fraud.

- Equifax: 1-800-685-1111. Call 1-800-525-6285 to report fraud.

You may also visit www.AnnualCreditReport.com to obtain a free copy of your credit report each year.

CREDIT SCORE

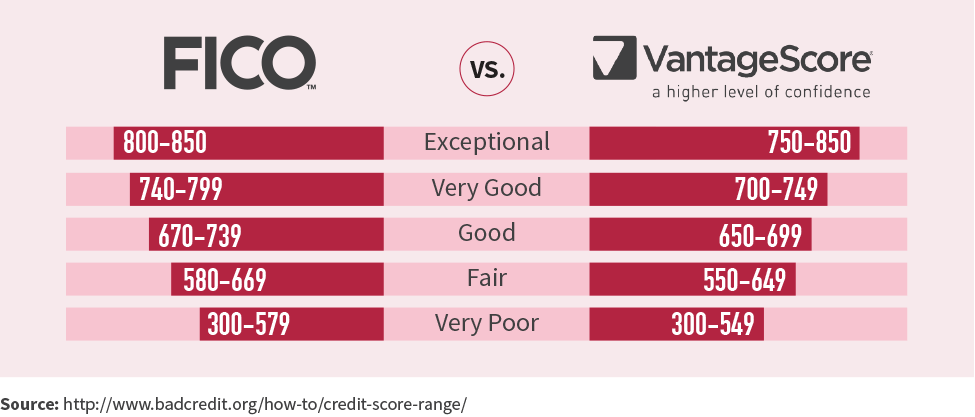

Based on your credit history, you are given a credit score. FICO and VantageScore are the major credit scoring services. Their credit scores range from 300 to 850. The higher your score, the more safe you are as a customer and lenders are more likely to approve you for loans or credit cards. Having a high credit score will also qualify you for lower interest rates and higher credit limits.

If you have a low credit score, you can improve your credit by:

- Paying your bills on time

- Reducing your debt

- Removing inaccuracies on your credit report

- Limiting your credit applications

- Avoiding new credit inquiries for a few months

- Building your credit history - avoid closing old accounts that have been open for a long time or have a high credit limit

PROTECTING YOUR CREDIT AGAINST FRAUD

Never give out your personal information over the phone or email. This includes:

- social security numbers

- bank account numbers

- credit card numbers, and

- debit card numbers.

Make sure you have different passwords for your online accounts.

Shred sensitive information such as bank statements, credit card applications and bills before throwing it away.

Set up fraud alerts on your accounts.

YOUR DEBT COLLECTION RIGHTS

Creditors and debt collection agencies must follow certain rules when trying to collect debt from you. They are NOT allowed to:

- call you at home more than twice in a seven-day period

- call you at work or elsewhere more than twice in a 30-day period

- call you at work if you've filled out a written request not to call you at work, and

- contact you directly if you've told them you have an attorney to handle your debts.

When dealing with you, creditors are also NOT allowed to:

- use profane or abusive language

- falsely threaten to take you to court or take other legal action

- reveal information about your debt to anyone else without your consent

- ask for post-dated checks from you, and

- withhold documents from you or your attorney that they intend to use to collect the debt.

TIPS FOR HANDLING DEBT

Many people use credit without understanding what getting into too much debt can do to them. Keep these tips in mind to handle your debt:

- If you're falling behind on your bills, contact the creditor to work out a payment deal.

- If you have a lot of debt, consider contacting a debt counseling service. These groups can help you consolidate your debt and work out deals with creditors.

- You can also take out a loan for your debt or file for bankruptcy. You should speak with an attorney first, because these options can really hurt your credit score.

- If you're getting credit card applications and junk mail that you don't want, call 1-888-567-8688 or visit www.optoutprescreen.com to opt out.